This is simple if you have eStatements within online or mobile banking. View your monthly bank statementīefore balancing your checkbook, you'll need access to your most recent bank statement.

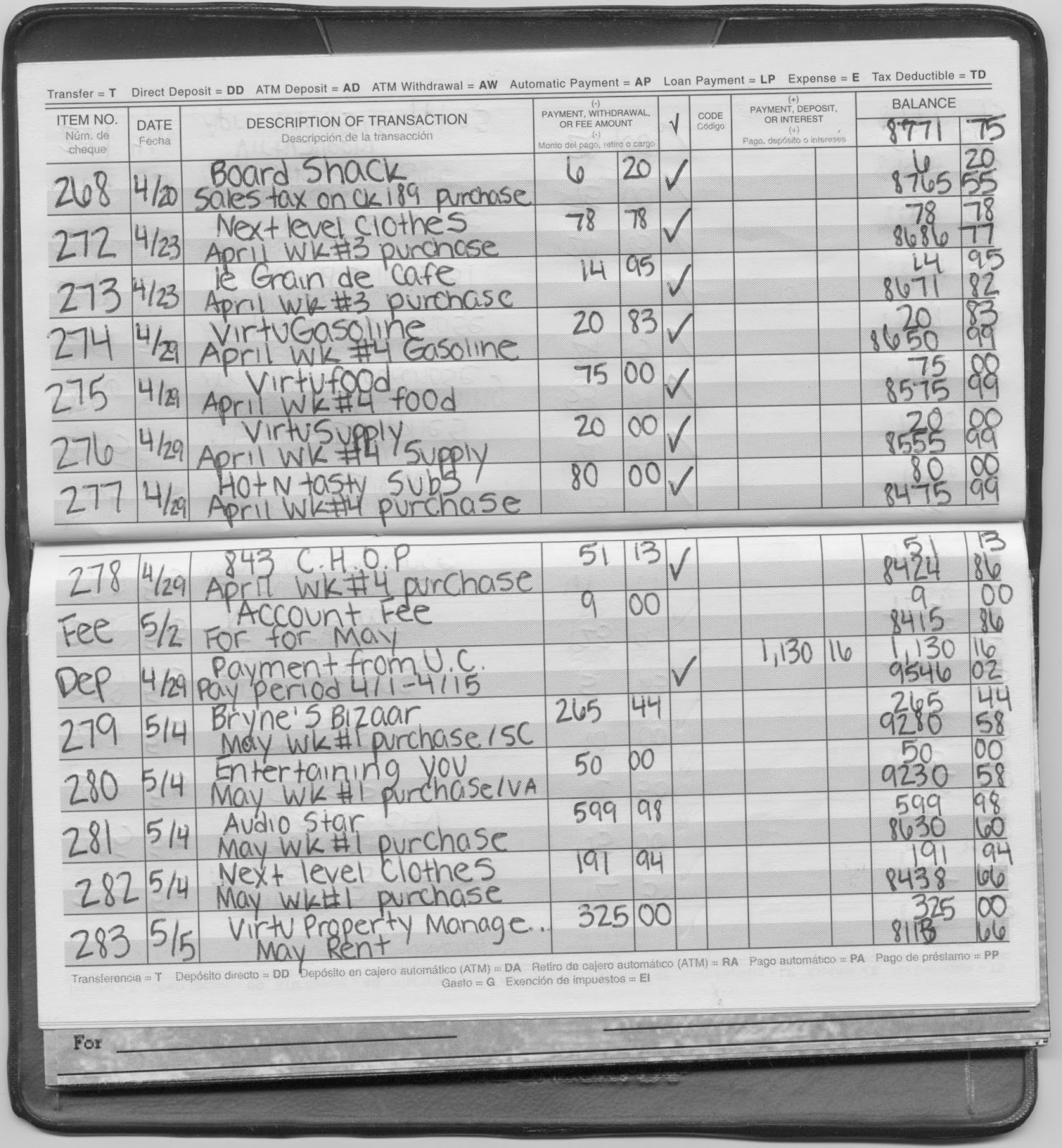

You need to know exactly how much money remains in your checking account if you hope to balance it. As soon as possible after making these transactions, write down the amounts in your checkbook ledger. This means that you must keep track of every time you use your debit card to fill up your gas tank, write a check or withdraw $20 in spending money from the local ATM. Be a good record keeperīalancing your checkbook all starts with keeping good records. In fact, with some basic bookkeeping abilities, you can quickly and accurately balance your checkbook to make sure that you never accidentally overdraw your account. Balancing your checkbook isn't as bad a task as it seems. That can lead to bounced checks and the fees that come with them.ĭon't fear, though. But what if you've forgotten about a check you wrote and it hasn't been cashed yet? You might mistakenly think you have more money in your account than you really have. Yes, you can check your balances online if you're a fan of digital banking. This doesn't mean, though, that it's not important to balance your checkbook on a regular basis. And with digital banking now so popular, it's easy for most consumers to quickly check their balances online. After all, balancing a checkbook is no one's idea of a good time. It's tempting when you pay so many of your bills online to skip on balancing your checkbook.

0 kommentar(er)

0 kommentar(er)